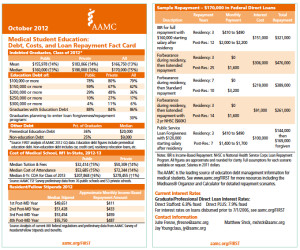

The Association of American Medical Colleges (AAMC) has a handy downloadable information guide on PSLF for physicians. The benefits of PSLF increase as the debt amount climbs. In an example on the AAMC website, a doctor has $170,000 in federal student loans and owes $195,000 at the start of repayment. He works for a nonprofit employer and qualifies for IBR.

He earns $50,000 as a resident during his first three years and pays $410 to $490 per month on his federal student loans. His salary increases to $120,000 in year four and goes up slightly thereafter. His payments are $1,400 to $1,700 in years four to 10.

Over 10 years, he will have made about $144,000 in loan payments and had $169,000 forgiven.

Click Chart Below to Enlarge:

Repost from AAMC (https://www.aamc.org/services/first/first_factsheets/166300/incomebasedrpymt_pslf.html):

Public Service Loan Forgiveness (PSLF)*

The PSLF program rewards borrowers for working in the non-profit sector. Borrowers must make 120 monthly payments while working fulltime (30-hours or more per week) at a non-profit, 501(c)(3), military or governmental organization. While most medical schools and teaching hospitals qualify, an Employment Certification for Public Service Loan Forgiveness form should

be submitted to confirm eligibility of the employer.

After making 120-qualifying monthly payments, the borrower can apply to have their outstanding federal student loan balance forgiven. For more details about PSLF, review the PSLF Fact Sheet . You can also use the “PSLF Forgiven” feature in the Medloans Organizer and Calculator to view potential forgiveness amounts.

How do the Repayment Plans and PSLF Work Together?

While in residency training, if you choose to make payments on your student loans, it’s likely that your stipend will allow for lower monthly student loan payments. Additionally, since many residency programs are located at non-profit teaching hospitals, these lower payments can count towards the 120-monthly payments needed to qualify for Public Service Loan Forgiveness.

Once residency training is finished, though a physician’s salary will increase, the required payment amount will never be more than what the standard 10-year payment amount would have been when initially entering repayment.

Therefore, the income-driven payment plans and PSLF work well together by allowing lower monthly payments during residency while also bringing you closer to loan forgiveness under PSLF.

Other loan forgiveness options available with the income-driven plans take 20- or 25-years to realize, but if PSLF is right for you, and you meet all the criteria, you could benefit from combining PSLF with an income-driven plan and experience loan forgiveness in a shorter period of time.

[…] hospitals, your payments could count towards the 120 required by PUBLIC SERVICE LOAN FORGIVENESS.3 Keep in mind if you join a private practice after residency, then your payments might not go […]