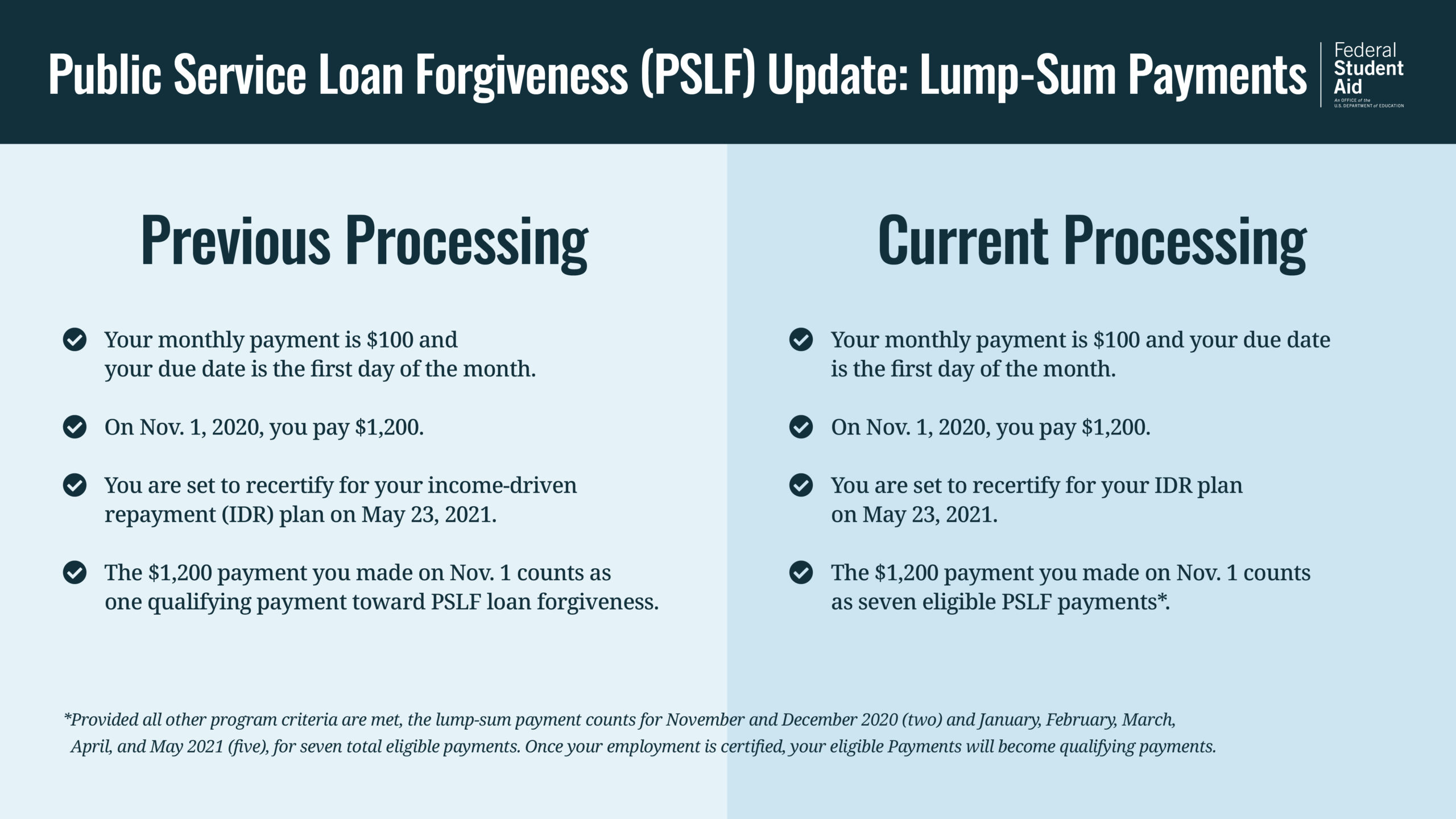

In the past, prepayments or lump sum payments did not count for PSLF. But that has changed according to the Department of Education, so now you can spread that lump sum across future months (assuming you qualify for PSLF and certify those months later). You can have those prepayments count “for up to 12 months or the next time you’re due to recertify for your income-driven repayment (IDR) plan, whichever is sooner.” Let’s look at the example from the Department of Education:

“Previous Processing” in the example was the old lump-sum rule. “Current Processing” is the new rule that allows the spread of the payments. As you can see in, the difference is the number of qualifying PSLF payments. In the old rule, you would only receive 1 qualifying payment. In the new rule, you would receive 7 qualifying payments.

The prepayments only is limited by either 12 months or the next recertification date since you’re essentially locking yourself into the monthly payment amount determined by your certified income on your IDR plan. If your income is lower, you could possibly benefit from the locked-in monthly payment amounts.

Remember, you still need to certify for those months you prepaid if you want those months to qualify for PSLF. Check in with your loan servicer, FedLoan Servicing, or the Department of Education for your individual case.