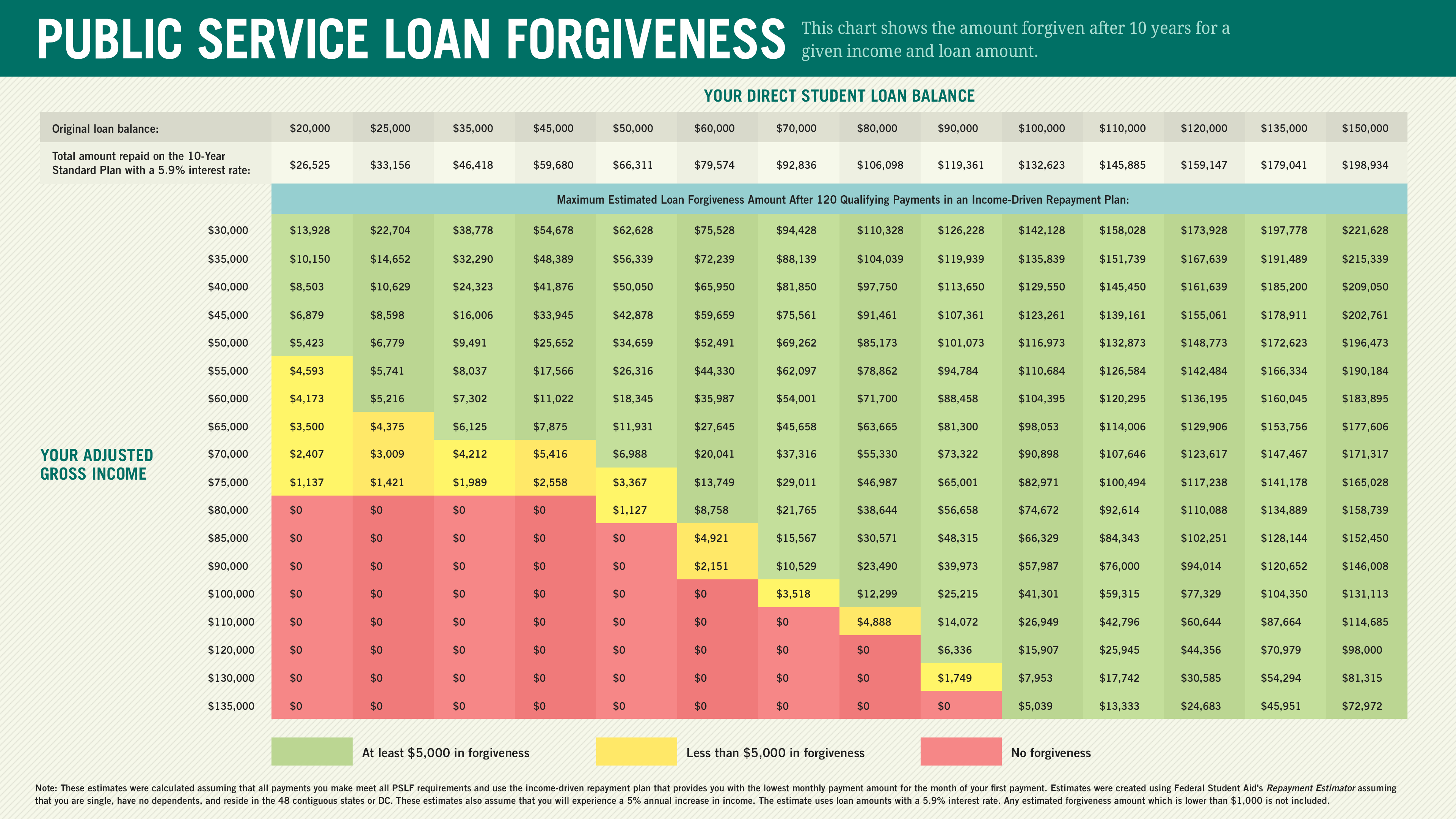

Did you know that if your income increases while you’re on IDR and PSLF, your monthly payment amount will also increases? Let’s take a look at an estimate of forgiveness based on adjusted gross income and overall federal student loan balance:

If you wanted to lower your PSLF payments and save for things like a mortgage, retirement, kids, you know…life, then the key is REDUCING YOUR AGI (Adjusted Gross Income). Since your AGI is tied to your monthly repayment amount (as reported on your Annual Income Re-certification), you can find creative, legal ways of reducing your AGI.

What can you do to try to lower your AGI? Here are a few:

- Max out your employer-provided 401k/403b to reduce your AGI. See https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-contributions.

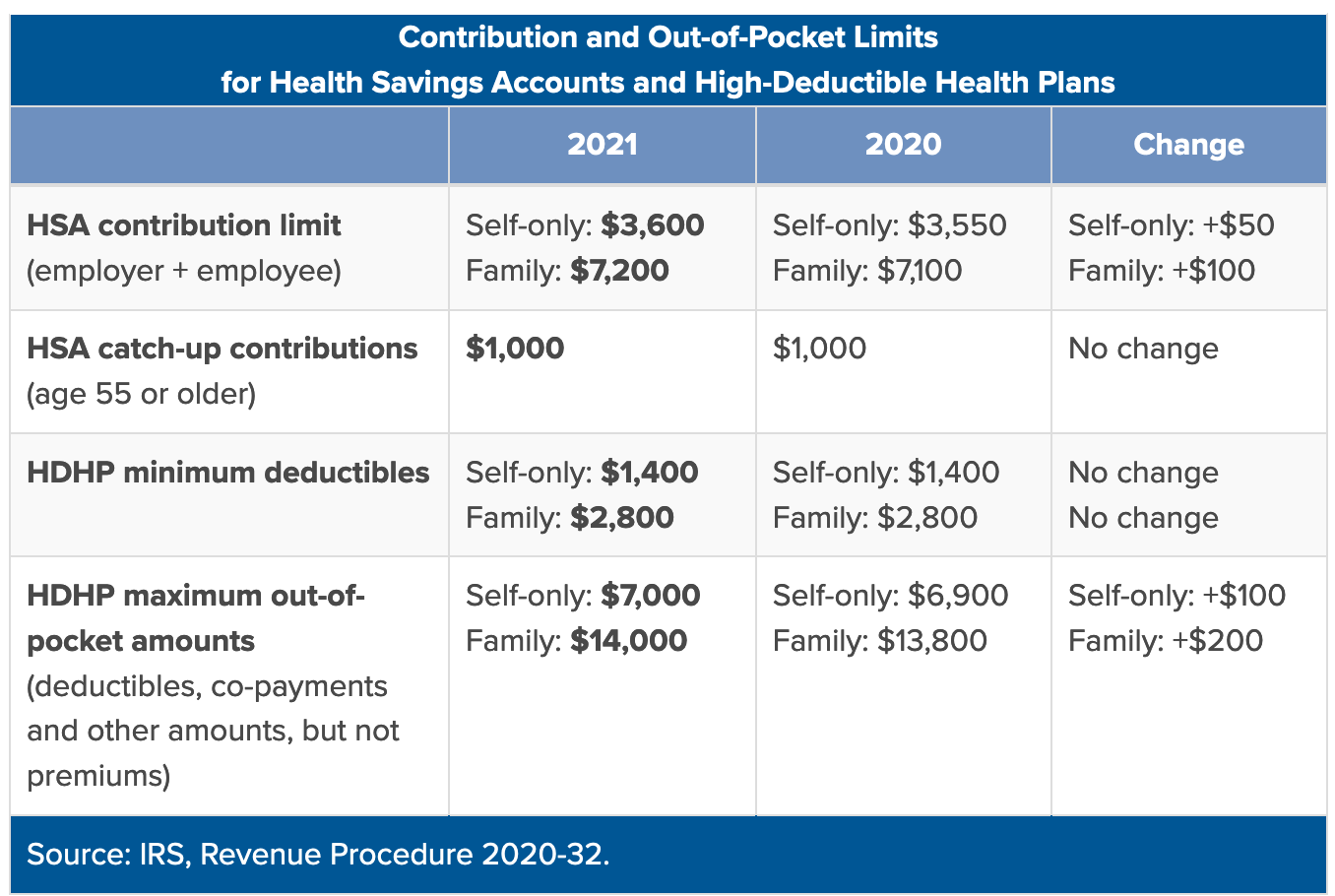

- Max out your HSA. See chart below and https://www.irs.gov/pub/irs-drop/rp-20-32.pdf.

- You may be able to deduct part of your contributions to a traditional IRA. See https://www.irs.gov/retirement-plans/ira-deduction-limits.

- Take advantage of the COVID-19 suspension of payments and interest! Don’t pay your loans while the COVID-19 suspension is active. Save those dollars for rainy days.

- If you ever have a dip in income, report it on your Income Re-certification form immediately! Your monthly repayment amount will drop afterwards. You don’t have to wait until your annual Re-certification date. Click on “I am submitting documentation early to have my income-driven payment recalculated immediately.”