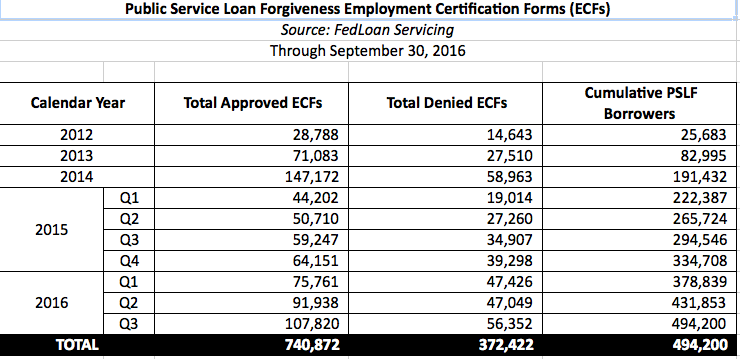

On December 20, 2016, the U.S. Department of Education’s Federal Student Aid (FSA) office posted a series of updates to its data center, a collection of key performance data about the federal student aid portfolio. The updates include a report about borrowers who have voluntarily submitted employment certification forms to express their interest in the Public Service Loan Forgiveness Program.

Key findings of the data updates include:

- Tracking shows borrowers are moving toward public service loan forgiveness. The Public Service Loan Forgiveness Program (PSLF) permits DL borrowers—who make 120 qualifying monthly payments under a qualifying repayment plan, while working full-time for a qualifying employer—to have the remainder of their balance forgiven. Although no borrower will be eligible for forgiveness under this program until October 2017, the Department introduced a voluntary Employment Certification Form in January 2012 to help borrowers track their progress toward meeting PSLF requirements. The report shows that through Sept. 30, 2016, about 1.1 million forms have been submitted, and of those, about two-thirds have preliminary certification.

- Enrollment in income-driven repayment plans (IDR) is increasing. As of September 2016, nearly 5.6 million DL borrowers were enrolled in IDR plans, a 33 percent increase from September 2015 and a 101 percent increase from September 2014. Nearly 1.2 million ED-held FFEL borrowers are enrolled in Income-Based Repayment and Income-Sensitive Repayment. Combined across the federally managed portfolio, approximately 5.8 million unique borrowers are enrolled in IDR plans; as of September 2016, 895,000 borrowers were enrolled in REPAYE.

- Consistent with recent trends, new defaults and delinquency rates continue to decrease. During the most recent quarter, about 280,000 DL recipients, or about 1.8 percent, entered default, compared to 1.9 percent one year ago. The DL delinquency rate has experienced yearly decreases of 10.6 percent by recipient and 8.5 percent by total dollar balance. The ED-held FFEL delinquency rate has experienced yearly decreases of 12.1 and 12.9 percent for recipients and volume, respectively.

Although no borrower will be eligible for forgiveness under this program until October 2017, the Department introduced a voluntary Employment Certification Form in January 2012 to help borrowers track their progress toward meeting PSLF requirements.

Borrowers are encouraged, but not required, to submit an ECF annually or whenever they change jobs to help track their progress toward meeting the PSLF eligibility requirements. Some borrowers may choose to wait until they are eligible for forgiveness before submitting documentation about their employment.

Cumulative PSLF borrowers are borrowers who have one or more approved ECFs. This report includes information only about those borrowers who have self-identified themselves as interested in PSLF based on their submission of an ECF.

Leave a Reply