We’ve been seeing a lot of news articles with unsuccessful PSLF stories, and we believe that it’s time for a reminder that everyone should be check the status of their PSLF by filing the ECF. This may not be a guarantee of PSLF, as we’ve seen with the ABA lawsuit, but it’s going to serve as some sort of written confirmation from the Department of Education that helps you determine if you qualify for PSLF.

We noticed that these rejected borrowers have one thing in common: no Employment Certification Form submitted. You can’t necessarily depend on your own PSLF count. You’re going to have an uphill battle if you just rely on your loan servicer’s customer service rep’s telephone reassurance, especially without further documentation (see https://www.cnbc.com/2018/12/18/borrowers-denied-public-service-loan-forgiveness-file-lawsuits.html).

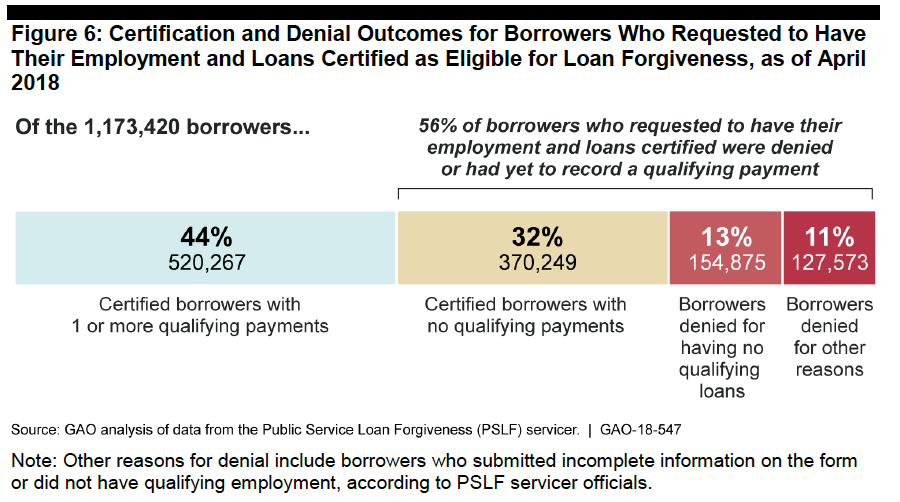

This PSLF confusion is also seen from the statistics released in September from the U.S. Government Accountability Office (GAO):

“Officials with the PSLF servicer said borrowers were frequently confused by program requirements related to qualifying loans, employment, repayment plans, and payments. For example, PSLF servicer officials said that borrowers were sometimes unaware that they were not on a qualifying repayment plan or that forbearance, deferment, and loan consolidation would affect their qualifying payments. PSLF servicer frontline customer service staff also said they frequently received calls from borrowers who were confused about whether their loans qualified for PSLF and other program requirements. Two other loan servicers we spoke to identified the same general areas of confusion among borrowers who call with questions about PSLF. In addition, borrower complaints reported by the Consumer Financial Protection Bureau indicate confusion with PSLF requirements related to qualifying loans and payments.” Page 13 of GAO Report (https://www.gao.gov/assets/700/694304.pdf)

Leave a Reply